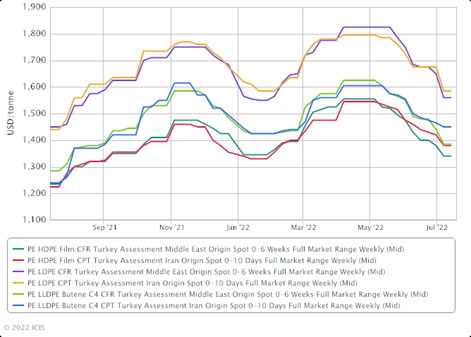

• Turkish polyethylene (PE) spot prices are steady this week amid very limited activity because of public holidays.

• Talk is extremely muted this week amid the Eid ul-Adha religious holiday in the region, combined with a separate public holiday in Turkey.

• Most players are out of the market this week and some will remain out for the following week as well.

• Activity is likely to pick up again at the end of July.

- There was a higher price seen for Low-density polyethylene (LDPE) this week, but this level was not confirmed in the wider market.

- One source saw linear low-density polyethylene (LLDPE) values above the range but there was no confirmation of these prices.

- High-density polyethylene (HDPE) values were heard within the assessed range this week.

- There is very little change to fundamentals with players generally out of the office.

- The recent weakening of the euro compared to the dollar has encouraged some demand for European product, which was previously thought to be too expensive for the Turkish market. However, because of the holidays in Turkey, very little business was concluded, with only one deal for European material heard this week.

- Overall buying interest remains low in Turkey as a result of the ongoing economic issues in the country, including high inflation, a weak exchange rate and a cap on lending at some banks.

Overview of the market in the third week of July

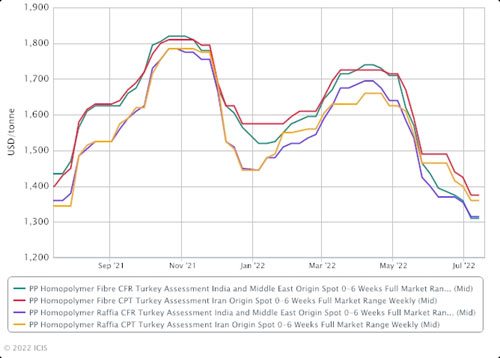

- Turkish polypropylene (PP) prices were stable this week amid public holidays in the region, which stalled activity.

- The Eid ul-Adha religious holiday, coupled with further public holidays in Turkey, limited trading this week, with most players out of the market.

- Most players are out of the market this week and some will remain out of the market next week as well.

- Activity is likely to pick up again at the end of July.

- Spot prices were unchanged this week due to the lack of trading seen in the market.

- One source saw lower levels for raffia material from the Middle East, but these values were not confirmed in the wider market.

- PP prices have been on a steady downtrend in recent weeks, but the market stabilised this week as activity stalled.

- Availability remains ample, though there is a lack of Iranian material in the market due to the 8% export tax on PP.

- Iranian sellers are instead focusing on the domestic market.

- There was talk that this tax may be removed, but there are no signs of this yet.

- Demand continues to be limited in Turkey due to the ongoing economic issues in the country, including high inflation, a weak exchange rate and a cap on lending at some banks.

- Transport costs between Iran and Turkey were seen at a $5/tonne increase this week, due to a buildup at the border.

- This was mainly attributed to the public holidays, with a lot of customs staff thought to be on holiday.